Sunday, 6 April 2025

EARTHQUAKE CONDOS CLEARANCE SALE

Friday, 4 April 2025

MAGANOMICS - PREMIUM AND PULLBACK

Thursday, 3 April 2025

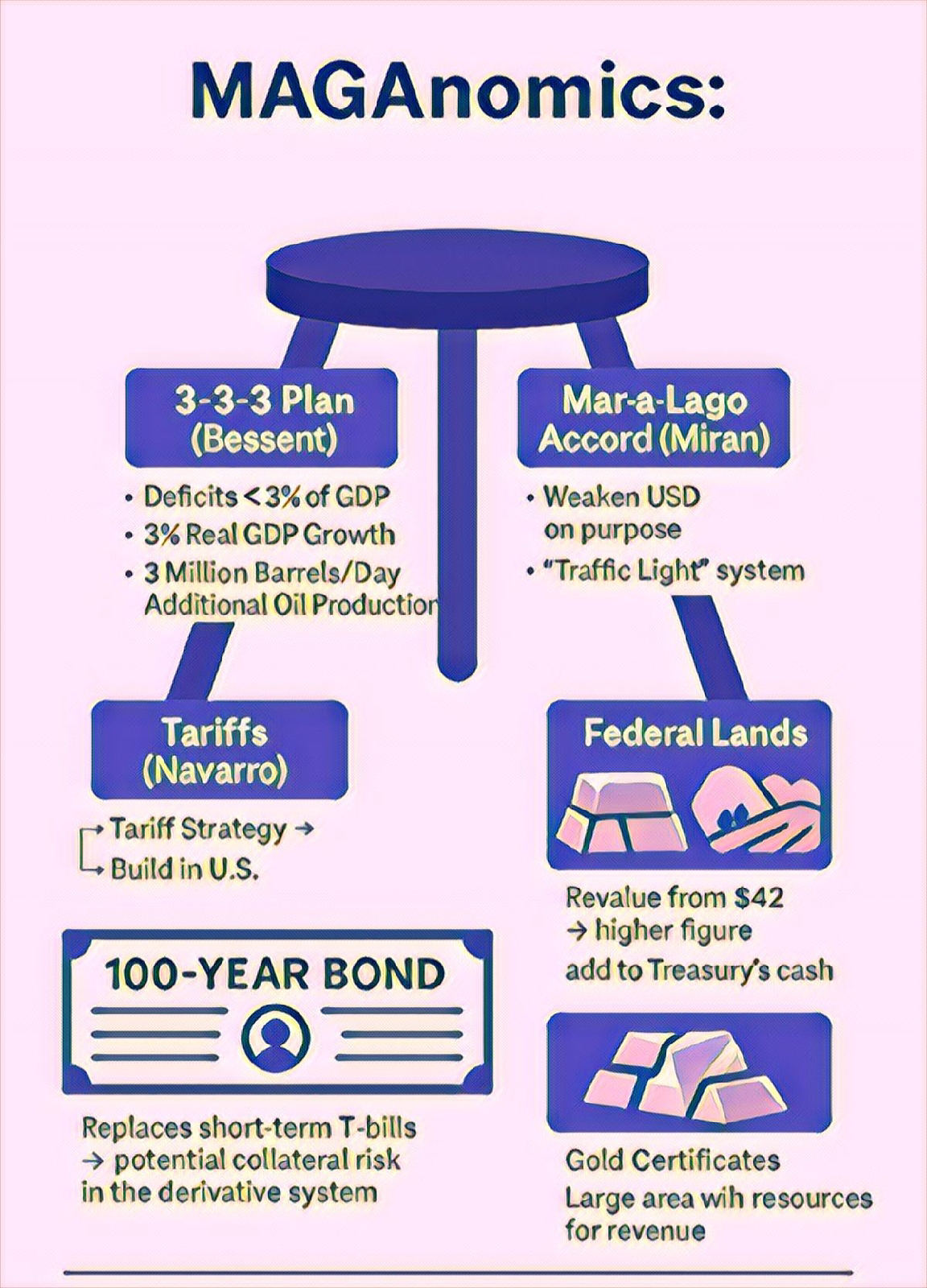

MAGAnomics

3 April 2025

Trump’s signature

principles can be seen as a “three-legged stool".

Leg One: The 3-3-3 Plan

Sometimes called the “three arrows,” championed by Treasury Secretary Bessent and staff

early on. The idea: keep deficits below 3% of GDP, achieve real GDP growth of

3%, and add about 3 million barrels per day of domestic oil production (or some

big chunk of increased energy output).

If you keep deficits under 3% and achieve 3% real growth (plus maybe 2% inflation = 5% nominal), the debt-to-GDP ratio goes down - and that's what counts. You don’t have to pay the debt off—just roll it over. As long as GDP keeps on growing faster than the debt, the ratio declines, which maintains sustainability and thus confidence.

The 3 million extra barrels of oil help keep energy prices down, contributing to growth and taming inflation.

Leg Two: Navarro’s Tariff Strategy

Peter Navarro is all about tariffs and reindustrialisation. The mainstream view

says tariffs are inflationary, like a sales tax on Americans. However, the

reality is that with consumers tapped out, foreign producers often eat the

tariff cost. That can be deflationary since it compresses producers’ margins.

It pushes foreign companies to relocate factories to the States to avoid tariffs,

creating U.S. jobs. Historically, the U.S. relied on tariffs from 1790 to

1962—what’s called “The American System". Income tax is a relatively recent thing. So this is actually a return to older

policies. Contrary to the notion that tariffs are a consumer tax, the cost

typically isn’t passed to American buyers if they can’t pay higher prices.

Instead, foreign producers absorb it.

Leg Three: Miran’s “Mar-a-Lago Accord”

Rickards coined that term in 2019 in his book Aftermath, see Chapter 6.

Stephen Miran is an adviser who wrote a key paper about the U.S. seeking a weaker dollar, reminiscent of the Plaza Accord in 1985. He argues that if foreigners try to offset U.S. tariffs by devaluing their currencies, the U.S. should intentionally weaken the dollar, not lose its reserve status, but orchestrate the devaluation.

That’s reminiscent of Nixon in 1971 and the Saudi agreement of 1974, and James Baker in 1985—both times the U.S. government, the Treasury Department, acting under direction from the President (and sometimes in coordination with the Federal Reserve) devalued the dollar heavily yet kept the reserve currency because of other geopolitical deals (like as we said the petrodollar in ‘74, or the official G5 deals in ‘85).

In addition

Miran also floated a plan to swap short-term Treasury bills for century bonds. These are 100-year zero-coupon or steep discount bonds. No coupon, you buy at a maybe 40% or 60% discount and in a hundred years your money is yours again..

This would ease the government’s immediate financing cost, but it could be a time bomb for the global collateral system because short-term T-bills act as key collateral in the 1000 trillion dollar derivatives markets. If you replace them with illiquid long-term bonds, you risk blowing up the derivatives market. That’s the bit that is most worrying in this whole maganomics

In addition, Miran suggested revaluing the Treasury’s gold certificates from $42 to something like the current price, $3,100 an ounce, adding eight hundred billion to the TGA Treasury General Account, without any new debt.

Turning to the assets side of the balance sheet (think like a businessman!), also monetising the enormous state lands - selling or leasing vast federal lands to monetise resources.

And we haven't talked about deregulation and we haven't talked about golden visas for high talent high net worth individuals and a host of other deals to kickstart the economy,

It’s a big, multi-step plan to reduce deficits, raise growth, reindustrialise via tariffs, cheapen the dollar... but with potential pitfalls if executed poorly (especially the T-bill swap).