Thursday, 5 June 2025

WE ARE DOOMED (WW3)

Wednesday, 4 June 2025

HOW THE PEOPLE WILL END THIS WAR

4 June 2025

1. The Approaching Tipping Point in the Ukraine War

A long war eventually burns out its own logic. Whether it's donors withholding funds, voters swinging toward peace candidates, a final catastrophic defeat on the battlefield, or a bankrupt Treasury unable to finance further arms production - there are many pathways that could lead this war to a conclusion.

But how will we know when the tipping point has truly been reached?

![]()

2. Signs of the Dialectic Shifting

First, cracks will begin to appear in the mainstream media narrative. Once loyal stenographers to the official war line, journalists will start revealing the bleak reality of the front lines. Articles will mention stalled offensives, morale problems, or whispers of fatigue.

Next, a few brave public figures - politicians, cultural icons, perhaps a military voice - will speak out. Not in favour of defeat, but in defence of truth, morality, and common sense.

The language will subtly change. No longer just “Russian aggression,” but phrases like “security concerns,” “strategic balance,” or even “pathways to dialogue” will enter the mainstream.

Then will come the economic reckoning. Editorials will question the ballooning cost of war - paid by taxpayers enduring service cuts at home. What started as noble resistance may begin to look like unsustainable waste.

Public mood will shift. Social media will amplify the outrage. Protesters will reappear - on high streets, on university campuses, on the steps of parliament.

![]()

3. Sensible Adjustments, Not Apologies

When this happens, there will be no formal apology. Instead, we’ll hear of “sensible adjustments to policy,” “reassessments,” or “fresh thinking on strategic objectives.” The dialectic - thesis, antithesis, synthesis - will do its quiet work. What was unthinkable will become inevitable.

And what then of those who staked so much on pride, certainty, and a single narrative? How will they cope when history begins to speak in a different voice?

![]()

NEW OPPORTUNITIES FOR SOFTWARE DEVELOPERS

AI VIBE CODING STARTUPS

RAY DALIO'S NEW BOOK, HOW COUNTRIES GO BROKE

1. The Big Debt Cycle Explained

- Early Stage:

- Mid Stage:

- Late Stage:

- Crisis Stage:

2. Indicators of Economic Vulnerability

- High Debt-to-Income Ratios:

- Rising Interest Payments:

- Dependence on Foreign Investors:

- Currency Depreciation:

3. The Role of Central Banks

4. Historical Context and Case Studies

5. Recommendations for Policymakers

- Fiscal Discipline:

- Productive Investment:

- Transparent Communication:

- Diversification:

1. HOW COUNTRIES GO BROKE — RAY DALIO’S BIG CYCLE EXPLAINED

Monday, 2 June 2025

TWO CENTURIES OF WAR WEST V. RUSSIA

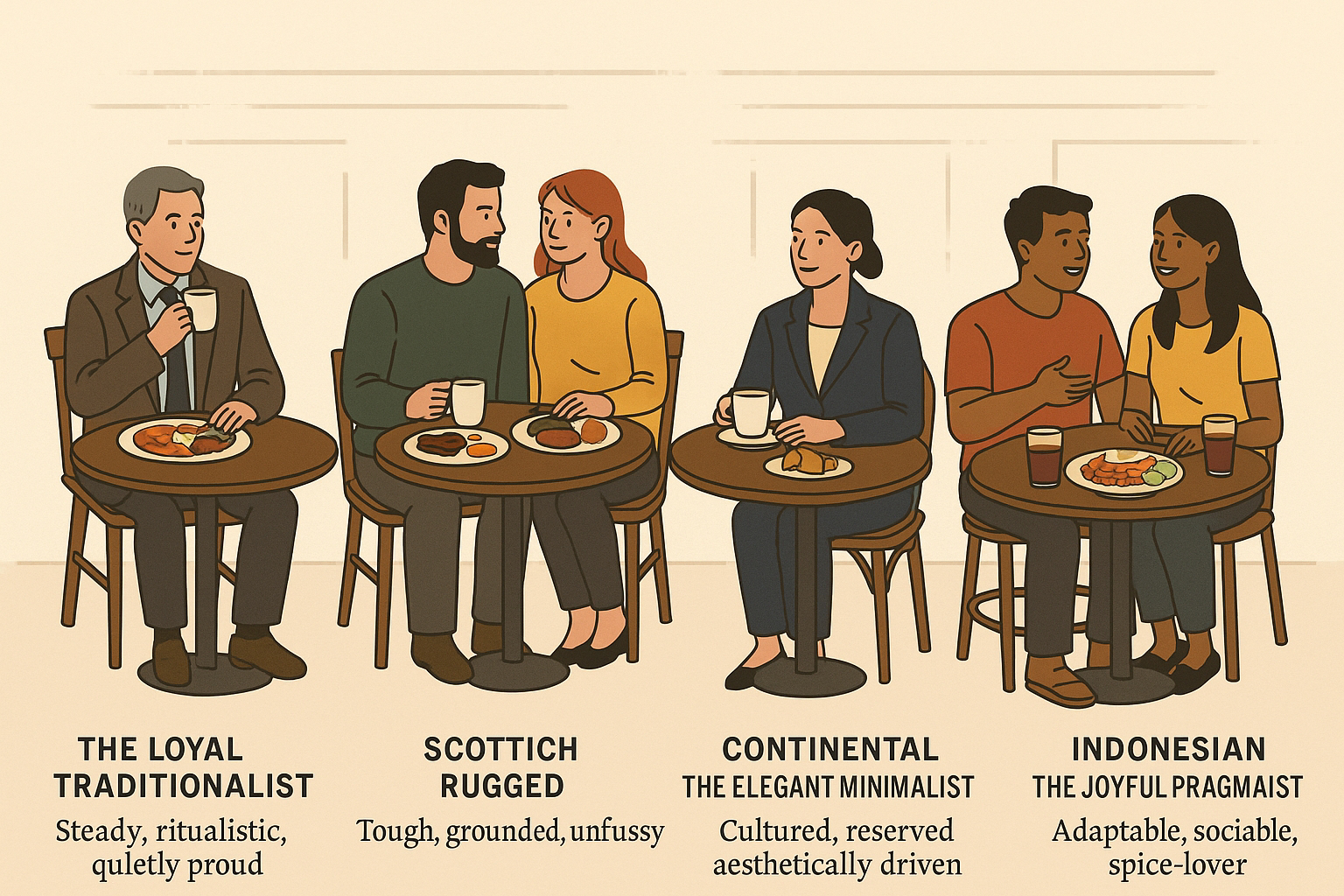

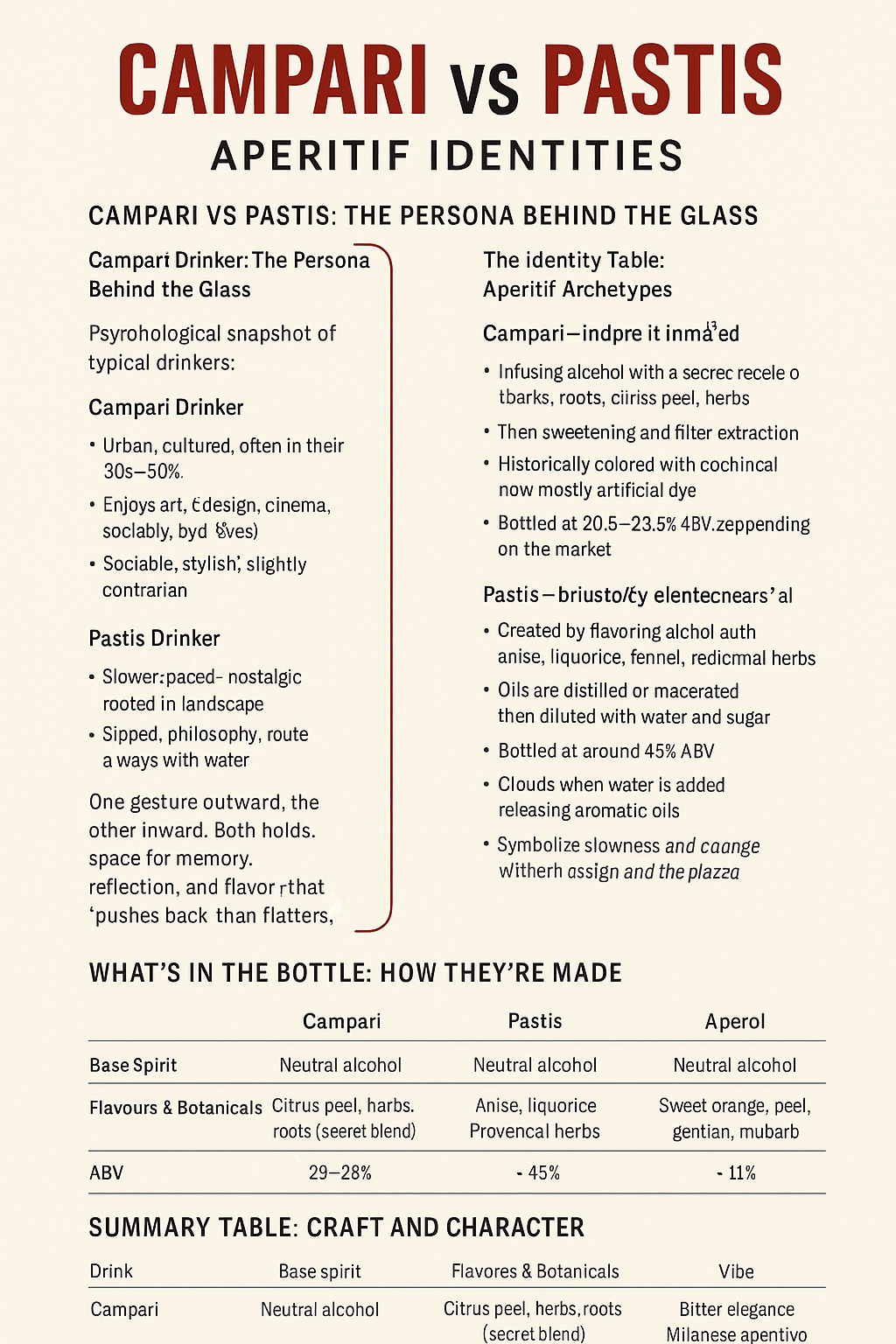

BREAKFAST IDENTITIES

Friday, 30 May 2025

PEARL CULTURES

TRUMP'S PLAN AND HIS ENEMIES INCL EUROPE

1. Core Thesis: Economic Shock as Strategy

Trump and senior officials describe their agenda as “economic shock therapy”, likening it to a necessary, painful reset to break dependency on low-wage imports and excessive government spending.

2. Tariffs and Protectionism

Tariffs on imports—especially from China—are central. The administration accepts that this will raise costs for consumers, but believes it will rejuvenate U.S. industry in the medium term.

3. Detox from Deficit and Bureaucracy

Treasury Secretary Bessent said: “We’ve become addicted to this government spending… There’s going to be a detox period.” The goal is to reduce deficits while cutting government involvements and reorienting the economy toward productive sectors.

4. Tax Cuts and Social Program Cuts

The Big Beautiful Bill enacted sweeping tax cuts and spending reductions in welfare and healthcare, shifting funds toward defence and border security. This mix of fiscal retrenchment and tax relief is intended to support industrial renewal, but places short-term strain on lower-income households.

5. Accepting Short-Term Pain for Long-Term Gain

Officials acknowledge the prospect of inflation, recession, and market disruption. Farmers and exporters may face difficulties. Consumers will feel inflation from tariffs. Stock markets might drop.

6. Broader Strategy: Unorthodox Trumponomics

This policy represents a paradigm shift from traditional Republican economics—industrial subsidies, capital controls, and strategic trade security carve-outs.

7. Risk and Reward

Potential rewards include a revival of manufacturing, reduced trade deficits, and fresh fiscal health. But risks include global retaliation, weakened recovery, an inflation-wage spiral, and the erosion of trust in conservative economic orthodoxy.

8. Political Gamble

The administration is counting on Republican voters' optimism, even amid cost pressures. Red-state voters are more tolerant of inflation if it brings industrial revival. But real-world pain (higher food costs, job losses in trade-dependent industries) could erode support.

Glossary

Economic shock therapy means deliberate, large-scale disruption to reset economic structures. A tariff is a tax on imports, used here to incentivise domestic manufacturing. Deficit detox refers to the intentional reduction of government spending and borrowing. Trumponomics is Trump-era economic policy focused on protectionism and security-linked trade.

Conclusion

Trump’s team is embarking on bold economic experimentation—accepting short-term hardship to pursue long-term structural change. Whether the reset achieves its industrial aims or provokes deeper instability depends on global pushback, domestic reaction, and whether the predicted benefits outweigh the immediate sacrifices.

Here’s a summarised analysis of the FT article “We have to rebuild our country: Donald Trump and his team pursue economic shock therapy”, conveying the main insights:

1. Core Thesis: Economic Shock as Strategy

Trump and senior officials describe their agenda as “economic shock therapy”, likening it to a necessary, painful reset to break dependency on low-wage imports and excessive government spending.

2. Tariffs and Protectionism

Tariffs on imports, especially from China, are central. The administration accepts that this will raise costs for consumers, but believes it will rejuvenate U.S. industry in the medium term.

3. Detox from Deficit and Bureaucracy

Treasury Secretary Bessent said:

> “We’ve become addicted to this government spending… There’s going to be a detox period.”

The goal is to reduce deficits while cutting government involvements and reorienting the economy toward productive sectors.

4. Tax Cuts and Social Program Cuts

The Big Beautiful Bill enacted sweeping tax cuts and spending reductions in welfare and healthcare, shifting funds toward defence and border security.

This mix of fiscal retrenchment and tax relief is intended to support industrial renewal—but places short-term strain on lower-income households.

5. Accepting Short-Term Pain for Long-Term Gain

Officials acknowledge the prospect of inflation, recession, and market disruption:

Farmers and exporters may face difficulties.

Consumers will feel inflation from tariffs.

Stock markets might drop.

6. Broader Strategy: Unorthodox Trumponomics

This policy represents a paradigm shift from traditional Republican economics - which are about industrial subsidies, capital controls, and strategic trade security carve-outs.

7. Risk & Reward

Rewards: Potential revival of manufacturing, reduced trade deficits, renewed fiscal health.

Risks: Global retaliation, weakened recovery, inflation wage spiral, and potential erosion of trust in conservative economic orthodoxy.

8. Political Gamble

The administration is counting on Republican voters' optimism, even amid cost pressures:

Red-state voters are more tolerant of inflation if it brings industrial revival.

But real-world pain (higher food costs, job losses in trade-dependent industries) could erode support.

Glossary

Economic shock therapy: Deliberate, large-scale disruption to reset economic structures.

Tariff: A tax on imports, used here to incentivise domestic manufacturing.

Deficit detox: Intentional reduction of government spending and borrowing.

Trumponomics: Trump-era economic policy focused on protectionism and security-linked trade.

Conclusion

Trump’s team is embarking on bold economic experimentation, all the while accepting short-term hardship to pursue long-term structural change. Whether the reset achieves its industrial aims or provokes deeper instability depends on global pushback, domestic reaction, and whether the predicted benefits outweigh the immediate sacrifices.

We have to rebuild our country’: Donald Trump and his team pursue economic shock therapy