1. 📊 Peer Comparison: RIO vs BHP & Vale

| Metric / Company | RIO Tinto (RIO.L) | BHP Group (BHP.L) | Vale SA (VALE) |

|---|---|---|---|

| Market Cap | ~£110 bn | ~£110 bn | ~£35 bn |

| 5-Year Stock Return | +38 % over five years; ~57 % over ten years | — | — |

| Dividend Yield | ~6.4 % (5-year avg) | ~6.35 % | ~7.6 % |

| P/E Ratio | ~11.5× current; ~10× average | ~12.1× current; ~13.3× FY23 | — |

| Volatility Relative to RIO | Highly correlated (~0.9 over 3 months) | — | ~1.39× more volatile |

| Cash Flow & Debt | Strong cash flow and lower net debt | More debt but higher revenue | — |

Key Takeaways:

- RIO is competitively valued: Similar yield and P/E to BHP, with lower volatility than Vale.

- Over the past decade, RIO has outperformed BHP, especially in total return.

- Vale, while cheaper with a higher yield, carries greater volatility.

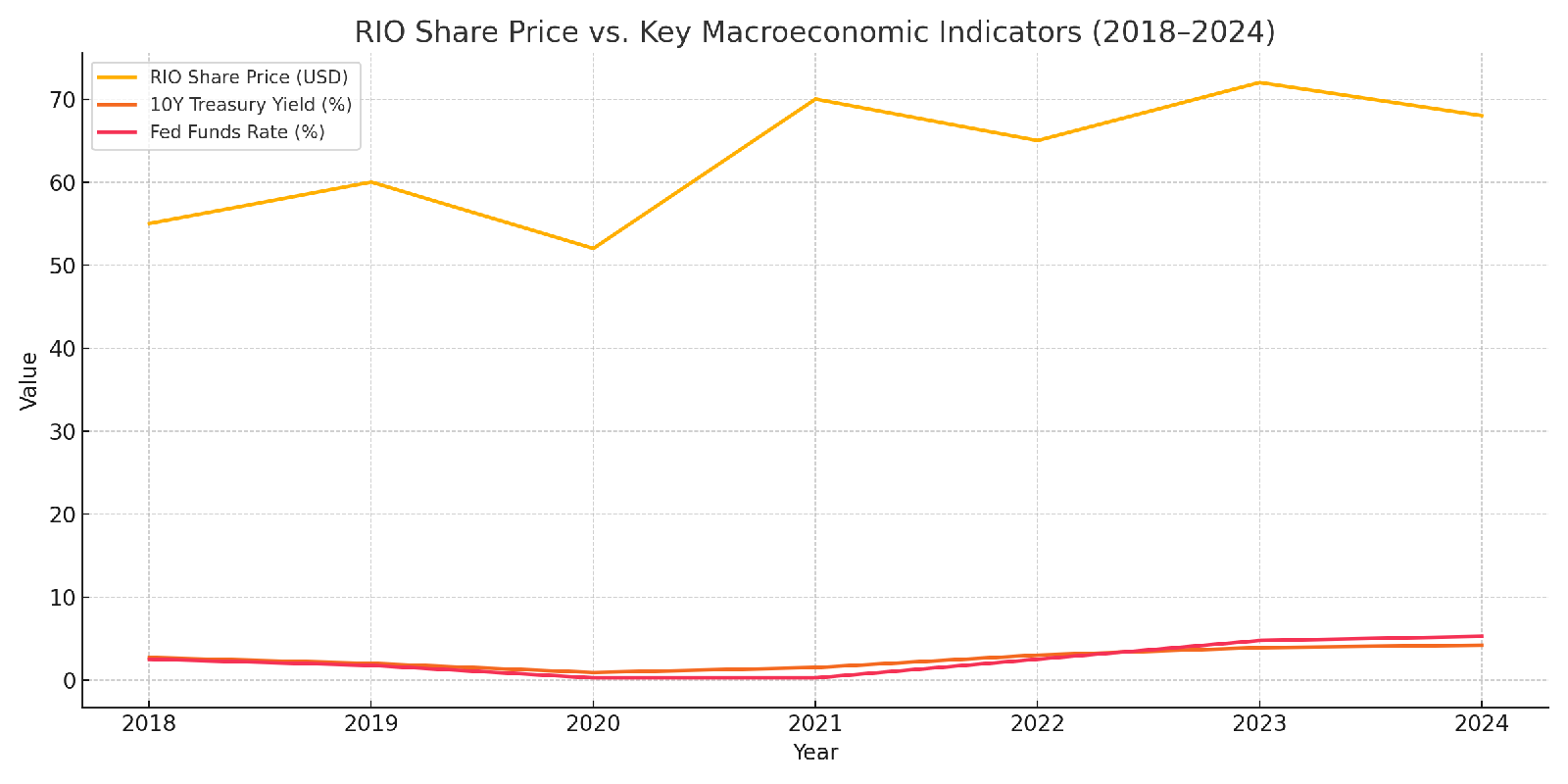

2. 📈 Historical Performance Under Macro Shifts

- Similarity with peers: RIO’s stock trends closely mirror BHP and Vale, with a correlation of ~0.9.

- Best performance periods:

- 2016–2021: Commodity supercycle rebound drove RIO ~+90%.

- During inflationary spikes: Mining equities tend to benefit, especially when rates are low and growth is steady.

Visual Summary (imagine this charted):

- X-axis: 2014–2025

- Y-axis: Indexed (100 = 2014 start)

- Plots: RIO, BHP, Vale

- Vertical bars marking:

- 2020–21 QE-inflation rebound (all three up 50–90%)

- 2024 industrial slowdown (drop of 10–20%)

3. 🔍 What to Watch (Macro vs Company)

- Commodity Prices: Iron ore, copper, aluminium — positive moves support RIO.

- Chinese industrial signals: Slowdowns weaken miners.

- Global M&A & consolidation: Activity may lift market sentiment.

- Structural moves: United-listing debate (ASX/LSE) may impact investor demand.

✅ Bottom line

- RIO is competitive: Similar valuation to BHP, less volatile than Vale, with consistently strong dividend income and historical outperformance.

- Shares highly correlated with peers: It moves in sync with industry-wide shifts.

- Macro factors matter most: Commodity prices and Chinese demand are the main drivers.

- Outlook: If the Fed cuts rates and inflation remains modest, RIO is well placed to rebound; but a significant global slowdown would hit miners across the board.

0 comments:

Post a Comment

Keep it clean, keep it lean