Friday, 18 July 2025

A HISTORY OF THE AGILE METHODOLOGY

AGILE AND SSADM COMPARED, WHAT IS A USER STORY

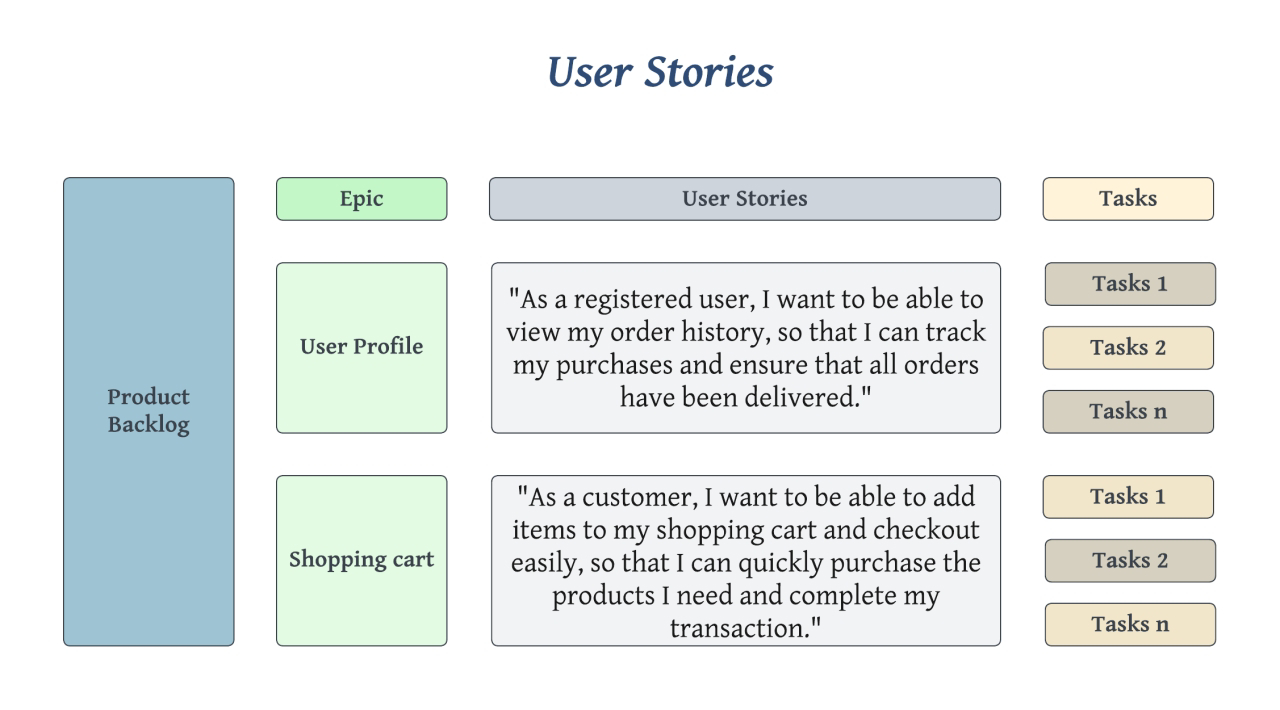

1. Summary: What is a User Story?

A user story is a short, simple description

of a feature or requirement written from the perspective of the person who

desires the functionality - typically a user or customer. In Agile development,

user stories replace traditional system requirements to promote flexibility,

collaboration, and fast iteration.

A user story typically follows the format:

“As a [type of user], I want [an action] so that [a benefit/a value].”

This ensures the feature is grounded in user value. User stories are

intentionally brief and act as placeholders for further conversation and

refinement. They are prioritised in a product backlog, broken down into epics

or tasks, and selected for development during sprint planning.

A well-written user story is INVEST:

- Independent

- Negotiable

- Valuable

- Estimable

- Small

- Testable

The 'Three Cs' of user stories are:

- Card: The written description (usually on a card or in a tracking system)

- Conversation: Dialogue among stakeholders to clarify and refine

- Confirmation: Acceptance criteria that confirm completion

This method supports iterative development, continuous feedback, and

stakeholder engagement.

2. Glossary of Agile User Story Methodology

· User Story: A brief, simple description of a feature from the user's perspective.

· Agile: A methodology emphasizing iterative development, collaboration, and flexibility.

· Product Backlog: A prioritized list of all desired work or features.

· Epic: A large user story that can be broken down into smaller ones.

· Task: A technical work unit derived from a user story.

· Sprint: A fixed time period for completing selected user stories.

· Sprint Planning: A meeting to choose which user stories to implement during a sprint.

· INVEST: Checklist for good user stories: Independent, Negotiable, Valuable, Estimable, Small, Testable.

· Three Cs: Card (description), Conversation (discussion), Confirmation (acceptance criteria).

· Acceptance Criteria: Conditions that must be met for a story to be complete.

· Customer-Centric: Focus on delivering value to the user, not internal technical needs.

3. Comparison of Agile User Stories vs. SSADM

SSADM (Structured Systems Analysis and

Design Methodology) is a waterfall methodology focused on thorough planning,

rigorous documentation, and structured stages: feasibility, requirements

analysis, logical data modeling, etc. It is best for stable and regulated

environments.

Agile uses evolving user stories instead of static requirements. It values

working software, frequent feedback, and adaptation. Documentation is minimal

and collaboration is central.

Agile’s user stories fit a 'Three Layered' approach to requirements:

1. Epics (high-level goals)

2. Stories (concrete features)

3. Tasks (developer-level implementation units)

In contrast, SSADM follows:

1. Business Requirements

2. Functional Specification

3. Technical Specification

Where SSADM assumes requirements are knowable upfront, Agile embraces change

and iterative clarification.

4. Glossary Mapping: Agile vs. SSADM

|

Agile Term |

SSADM Equivalent |

Comment / Mapping Logic |

|

User Story |

Process Specification |

Describes functionality; refined into DFD and ELH in SSADM |

|

Epic |

Business Area Definition |

High-level domain requirements |

|

Task |

Elementary Process / Module |

Breakdown of a process step in DFD |

|

Product Backlog |

Requirements Catalogue |

Centralised list of required system behaviours |

|

Sprint |

Phase in Project Plan |

Time-boxed execution within structured lifecycle |

|

Acceptance Criteria |

Test Specification |

Formal validation in SSADM |

|

Three Cs |

Structured Interview + Requirement Statement |

Story lifecycle mirrors early SSADM stages |

|

INVEST |

Requirement Quality Guidelines |

SSADM lacks explicit acronym but uses best practice |

|

Card |

Requirement Entry |

Initial placeholder; becomes documented formally in SSADM |

|

Conversation |

Stakeholder Workshops |

Corresponds to structured interviews and JAD sessions |

|

Confirmation |

Verification via Test Plan |

Formalised in SSADM Test and Evaluation phase |

|

Backlog Grooming |

Requirements Review Meeting |

SSADM equivalent is periodic review cycles |

|

Logical Model |

LDM (Logical Data Model) |

Agile infers data; SSADM models explicitly |

|

Flow of Interaction |

DFD (Data Flow Diagram) |

DFDs model data movement—analogous to interaction flow |

|

State or Scenarios |

ELH (Entity Life History) |

Entity behaviour over time; maps loosely to user scenarios |

Sunday, 13 July 2025

THIS ORDER IS FINISHED, HOW TO REPLACE IT

Sunday, 6 July 2025

THE BRITISH EMPIRE HAS NOT DISAPPEARED, IT HAS DE-MATERIALISED

Saturday, 5 July 2025

4TH OF JULY. HOW INDEPENDENT IS AMERICA OF BRITAIN?

Wednesday, 2 July 2025

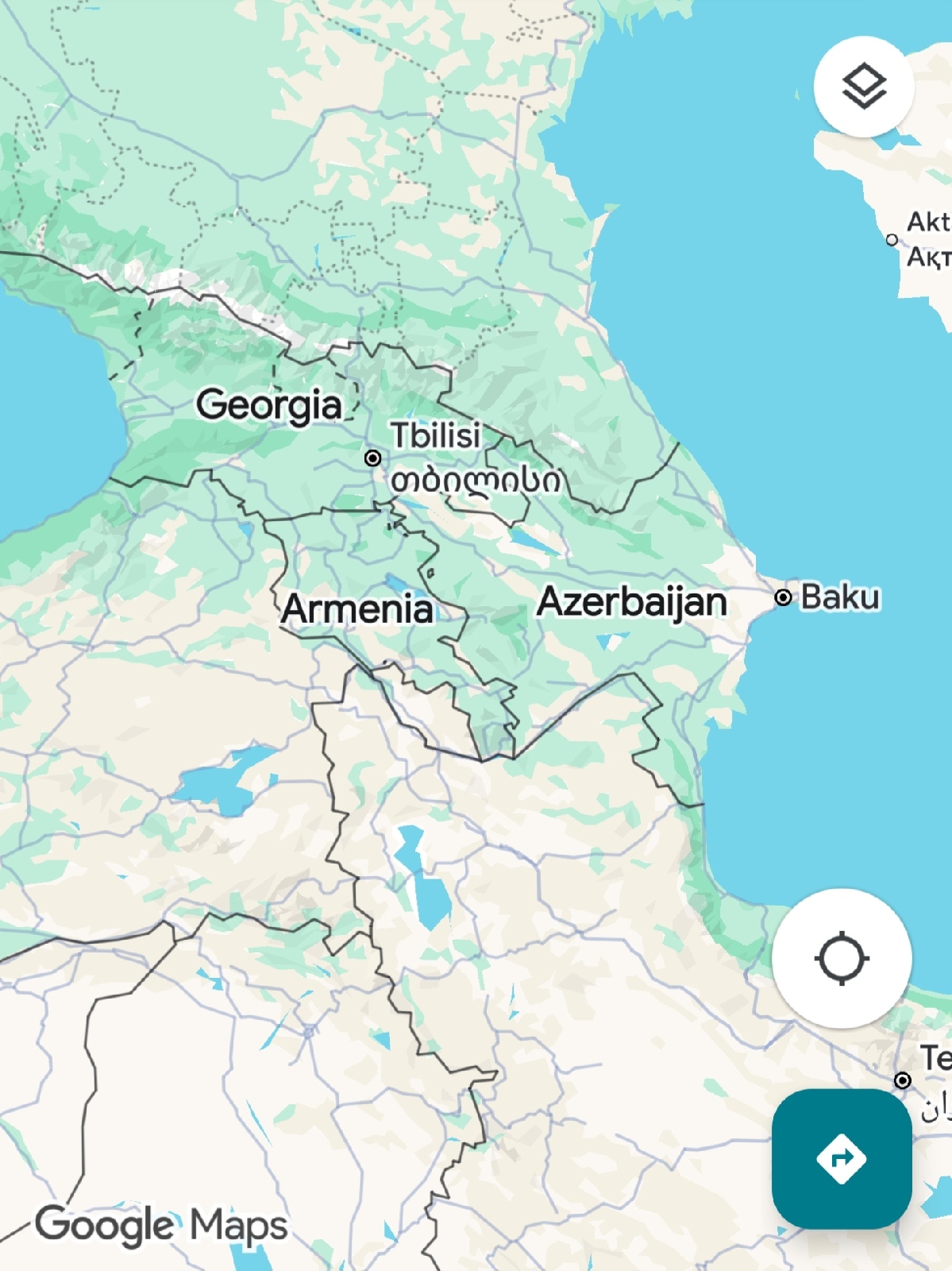

THE SIGNIFICANCE OF THE CAUCUSES

Saturday, 28 June 2025

UKRAINE, THE EU AND THE BROKEN STAIRCASE TO EU MEMBERSHIP.

Ukraine, the EU, and the Broken Staircase to Europe

1. The Promise That Sparked a Revolution

The 2014 Maidan uprising, known as "EuroMaidan," was driven by a single powerful belief: that Ukraine was on a path toward integration into the European Union. The EU Association Agreement, though technically limited to trade and legal convergence, was interpreted by many Ukrainians as a concrete first step toward eventual EU membership. When then-President Viktor Yanukovych suspended its ratification under pressure, mass protests erupted. The square Maidan filled, the flags waved, and eventually, the government fell. But the European dream remains unfulfilled.

2. A Long-Held Aspiration

While NATO membership was deeply divisive in Ukraine before 2014, EU membership was not. Polls showed consistent majority support for joining the EU. This aspiration was not merely bureaucratic, it was existential. Ukrainians wanted to live in a rule-based society, to travel freely, and to be anchored in a European future. EuroMaidan was as much a cry for dignity and direction as it was about paperwork and trade.

3. Russia's Objection: A Rational Trade Concern

Western narratives often paint Russia’s opposition to Ukraine’s EU Association Agreement as political meddling. But there is a crucial economic dimension that is often ignored.

At the time, Ukraine already had a free trade agreement with Russia under the CIS (Commonwealth of Independent States) framework. If Ukraine also entered into a deep trade agreement with the EU, then European goods could enter Ukraine tariff-free, and from there, be re-exported into Russia—bypassing Russian import restrictions and duties.

In short: Russia risked losing control over its external trade policy, as Ukraine would become a conduit for EU goods. The arrangement would undermine Russian domestic producers while allowing European exporters backdoor access to the Russian market.

Ironically, when the EU and UK negotiated the Northern Ireland Protocol after Brexit, the EU used the exact same argument to protect its single market: that British goods could enter the EU via Northern Ireland unless strict customs controls were implemented. In this light, Russia’s objections to the EU-Ukraine deal appear not only understandable but identical to EU logic - the logic remains the same, but the EU flipped for political reasons.

4. The Conflict Begins

When Yanukovych tried to renegotiate the deal - proposing trilateral talks involving Russia - the EU refused. The EU deemed the Association Agreement non-negotiable and would not change "a single punctuation mark". That refusal - and the pressure it created - triggered the sequence of events that led to regime change (a coup supported by the CIA, according to many independent analysts), Crimea’s annexation, and eventually the war.

Many Ukrainians believed EU membership was within reach. The movement even took the name “EuroMaidan.” Websites, protest art, and banners bore the EU flag. And so when the war began, the hardship was endured under the belief that it was part of the price to “return to Europe.”

5. A Shattering Disillusionment

Now, as Brussels signals cold feet and the possibility of EU entry fades, the emotional toll may be immense. A broken promise on EU membership would not just be a diplomatic setback—it would be a psychological catastrophe for a population that endured immense suffering under the assumption that their sacrifices had meaning.

Yet current opinion polling though sparse and difficult to trust under martial law, suggests that many Ukrainians are exhausted. 72% reportedly support a ceasefire or freezing of the conflict, and only 16% favour continuing the war indefinitely. Enthusiasm for reclaiming all lost territory has waned.

Still, bitterness could erupt if EU membership is formally ruled out. It would signal that the entire Maidan movement - the hundreds of thousands of deaths, the war and devastation of Ukraine's built environment, the economic devastation - was in vain, all in vain. As one commentator noted, Ukrainians followed a staircase labelled "Europe"—and now find it leading nowhere.

6. Conclusion: The Illusion That Fueled the Fire

EU membership was never a guarantee. But it was treated as a moral contract, a shared dream between Ukraine and the EU. If that promise is broken, it may not spark another revolution, but it will deepen the sense of betrayal, trauma, and fatigue, already spreading through a shattered nation.

Tuesday, 24 June 2025

FALLOUT FROM AMERICA BOMBING IRAN'S URANIUM NUCLEAR FACILITIES.

Monday, 23 June 2025

TRUMP BOMBS IRAN'S TOP THREE NUCLEAR FACILITIES

Saturday, 21 June 2025

ISRAEL'S ECONOMIC FRAGILITY

Friday, 20 June 2025

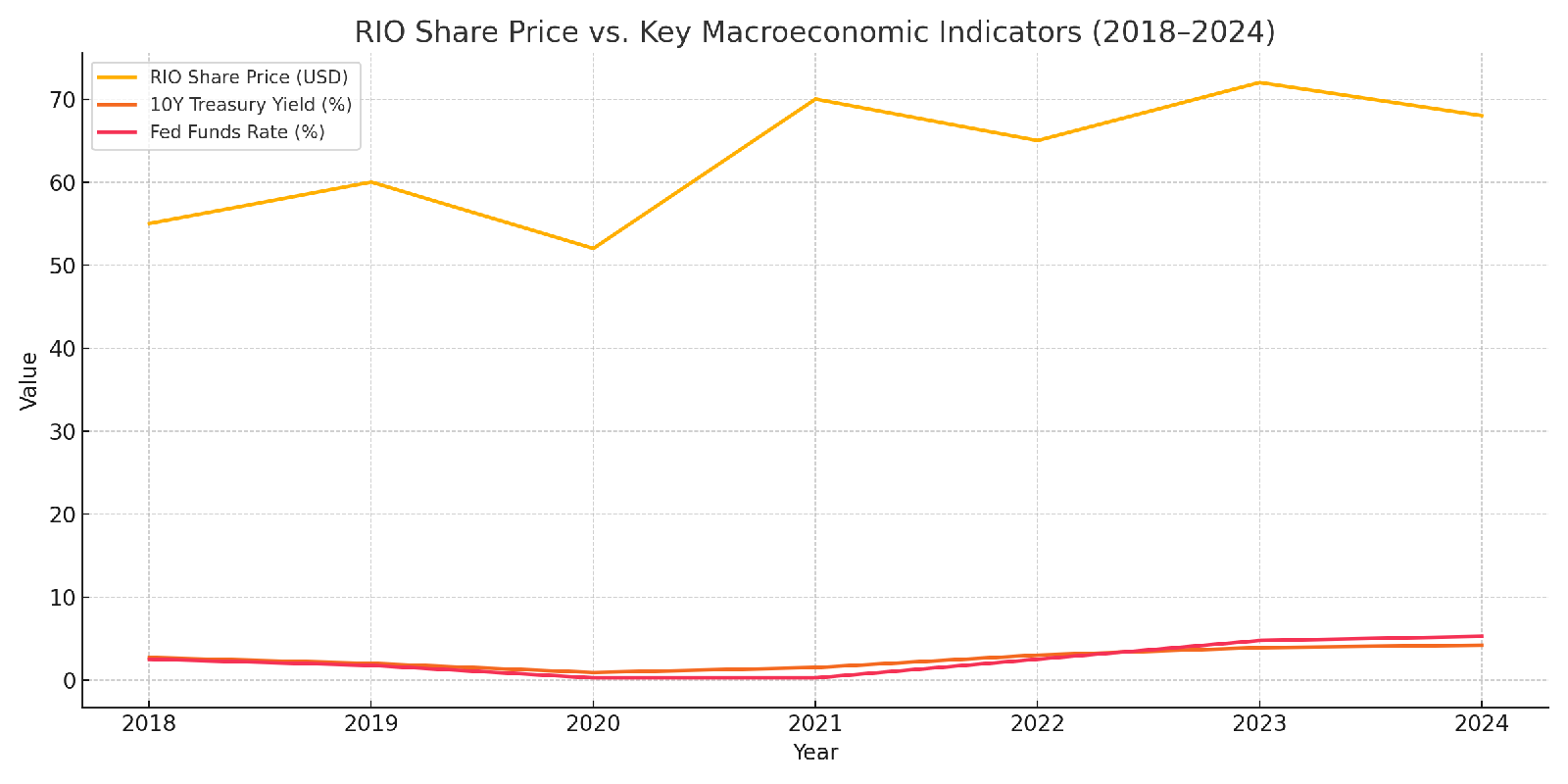

RIO - ANALYSIS AT 20 JUNE 2025

1. 📊 Peer Comparison: RIO vs BHP & Vale

| Metric / Company | RIO Tinto (RIO.L) | BHP Group (BHP.L) | Vale SA (VALE) |

|---|---|---|---|

| Market Cap | ~£110 bn | ~£110 bn | ~£35 bn |

| 5-Year Stock Return | +38 % over five years; ~57 % over ten years | — | — |

| Dividend Yield | ~6.4 % (5-year avg) | ~6.35 % | ~7.6 % |

| P/E Ratio | ~11.5× current; ~10× average | ~12.1× current; ~13.3× FY23 | — |

| Volatility Relative to RIO | Highly correlated (~0.9 over 3 months) | — | ~1.39× more volatile |

| Cash Flow & Debt | Strong cash flow and lower net debt | More debt but higher revenue | — |

Key Takeaways:

- RIO is competitively valued: Similar yield and P/E to BHP, with lower volatility than Vale.

- Over the past decade, RIO has outperformed BHP, especially in total return.

- Vale, while cheaper with a higher yield, carries greater volatility.

2. 📈 Historical Performance Under Macro Shifts

- Similarity with peers: RIO’s stock trends closely mirror BHP and Vale, with a correlation of ~0.9.

- Best performance periods:

- 2016–2021: Commodity supercycle rebound drove RIO ~+90%.

- During inflationary spikes: Mining equities tend to benefit, especially when rates are low and growth is steady.

Visual Summary (imagine this charted):

- X-axis: 2014–2025

- Y-axis: Indexed (100 = 2014 start)

- Plots: RIO, BHP, Vale

- Vertical bars marking:

- 2020–21 QE-inflation rebound (all three up 50–90%)

- 2024 industrial slowdown (drop of 10–20%)

3. 🔍 What to Watch (Macro vs Company)

- Commodity Prices: Iron ore, copper, aluminium — positive moves support RIO.

- Chinese industrial signals: Slowdowns weaken miners.

- Global M&A & consolidation: Activity may lift market sentiment.

- Structural moves: United-listing debate (ASX/LSE) may impact investor demand.

✅ Bottom line

- RIO is competitive: Similar valuation to BHP, less volatile than Vale, with consistently strong dividend income and historical outperformance.

- Shares highly correlated with peers: It moves in sync with industry-wide shifts.

- Macro factors matter most: Commodity prices and Chinese demand are the main drivers.

- Outlook: If the Fed cuts rates and inflation remains modest, RIO is well placed to rebound; but a significant global slowdown would hit miners across the board.